Annual Report 2024

Affinity Plus had a steady year in 2024, allowing us to continue our role as a secure financial resource for our growing membership. We also added new branches, upgraded technology, and elevated our security to enhance our membership’s banking experience.

And we continued to receive recognition for our efforts to build a better banking experience for our members: We earned awards such as Forbes Best-in-State credit union and Top Workplace from the Star Tribune, both for the 7th year in a row.

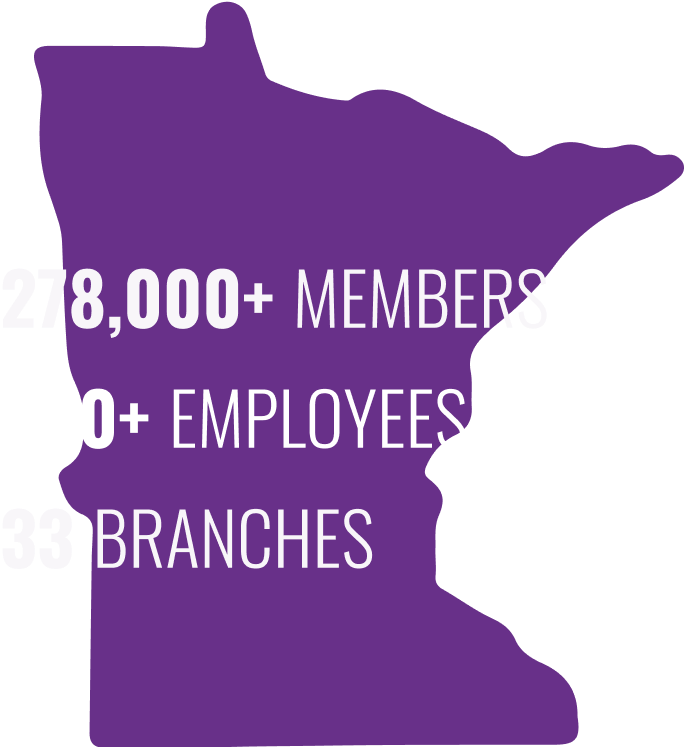

Who We Are

As a not-for profit, we put people over profit. The banking cooperative started in 1930 as a way for a community to support its members and help them succeed. For 95 years, we’ve continued that tradition with caring, integrity, and learning.

Our Vision

To be the best place our members will ever bank and our employees will ever work that results in thriving communities.

Our Purpose

As a member-owned cooperative, we empower members to achieve their goals through meaningful banking experiences and a trusted financial partnership.

Our Values

Our values are Caring, Integrity, and Learning.

President's Report

2024 showed us that putting people before profit continues to be a successful way to do business, with steady and secure growth. We remain a very strong and healthy organization for our members, for our communities and for our employees.

Our members faced another volatile rate market in 2024, and I’m proud of how Affinity Plus showed up for them as their go-to resource for financial services. We had solutions ready when our members needed us, often proactive with our support.

And that goes beyond Minnesota. Our members live in every state in the country, as well as nearly every nation in the world. When Los Angeles burned with wildfires, we reached out to every one of our 180 members in LA County, ready with solutions to support them. Hurricanes Helene and Milton affected more than 2,800 members, and we checked in with all of them. We have more than 275,000 members, and each one of you matters to us.

We renovated our branch in Rochester and added branches Virginia, Richfield, and Shakopee to accommodate our growing membership, and we also see future expansion opportunities through mergers.

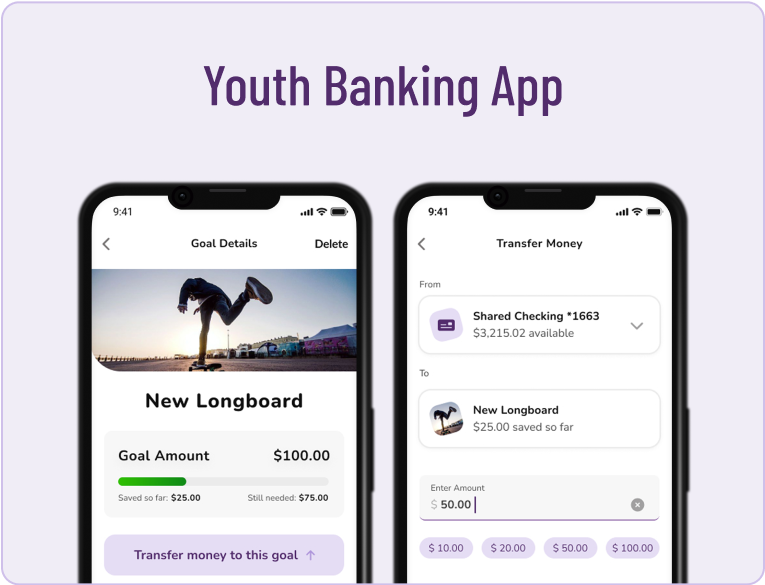

One of our major projects in 2024 to make the membership experience even better was building a great new upgrade for our digital banking services, debuting in early 2025. We introduced our new Youth Banking App for our younger members and their parents. Our older members benefitted from our new Medicare advising service, saving them an average of $800 on their current plans.

This human-centered approach earned local and national awards as a top employer, as well as accolades from Forbes and Newsweek for our banking services.

We continued to work with Arise Community Credit Union as a resource for them as they bring resources to underserved banking communities, and we gifted $250,000 to the new Tribe Federal Credit Union seeking to establish their provisional credit union charter, as they raise money in the Twin Cities

I’m also proud that Plus It Forward Day continues to gain momentum in its 11th year, with more than 130,000 credit union employees across the country spending Indigenous Peoples’ Day volunteering to make their communities better places. And 2024 was my final year as Chair of the Board of Directors at Special Olympics Minnesota, though I’ll continue to serve on the board through the 2026 Special Olympics USA Games taking place in our great state.

This was a year that once again showed us who we are as a credit union and as a community. It’s not about profit at all costs – it’s about wanting to keep money in our members’ pockets. I’m looking forward to the credit union continuing to prove that in 2025, and beyond.

Dave Larson

President/CEO

Board Chair's Report

2024 was my final full year as Chair, and I’m proud to say we accomplished our goals to ensure that we keep evolving as a credit union to the benefit our members and employees.

As a Board of Directors, we’re charged with providing representation for the membership as well as fiscal responsibility while we consider the future. Our main goal over the past three years has been to find ways to ensure that this organization remains as dedicated to its employees and members as it is today.

Much of that work was done within the Board itself, with new policies to help keep the Board refreshed and make sure diverse perspectives are represented. This is important, because the Board helps the Chief Executive Officer see and hear what matters to the people at Affinity Plus.

The credit union received more awards and accolades in 2024 than we did in 2023. And that’s only possible because we value all of our employees and members. Diversity in experience and knowledge is key to running a successful organization, and one of our greatest strengths at Affinity Plus.

As long as we keep that in the forefront of our decision-making, we’ll keep achieving these amazing results. We have an incredible workforce, feeling of community, and engagement at Affinity Plus. It’s a kind of camaraderie you can’t fake or buy, and our leadership is a big reason why.

Thank you to CEO Dave Larson for continuing to champion diversity, equity, inclusion, and belonging. And thank you to our employees for continuing to show up and making Affinity Plus such an amazing place.

Robyn Cousin

Board Chair

Financials

Total Assets

As a relationship-based financial co-operative, the credit union's assets primarily consist of loans to members.

On a much lesser scale, the credit union also maintains cash reserves, as well as physical property like branch locations.

Net Income

The amount of revenue remaining after all expenses are paid.

These funds serve to expand the credit union's capital cushion, to provide funding for continued growth and innovation.

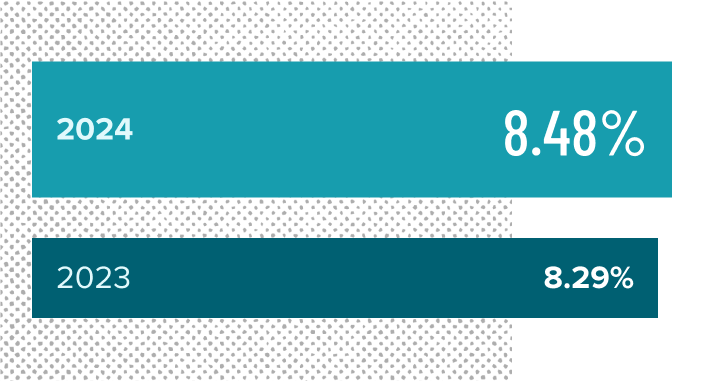

Net Worth Ratio

This is a primary measure of a credit union's capital strength. It signifies its ability to grow member relationships, fund innovation, and weather economic uncertainty.

The credit union’s insurer, the National Credit Union Administration (NCUA), requires a net worth ratio of at least 7.00% to receive its highest rating of “well-capitalized”.

Employer of Choice

Star Tribune’s Top Workplaces

We’re #3 Top Workplace in Minnesota, according to the Star Tribune’s Top Workplaces ranking.

USA Today Top Workplaces

USA Today agreed, naming us one of the Top Workplaces in the nation.

Forbes Best in State

Affinity Plus is also one of the best credit unions in Minnesota for members, said Forbes (for 7th year in row).

Newsweek Best Regional Banks & Credit Unions

Newsweek also got in on the action, naming Affinity Plus as one of American’s Best Regional Banks and Credit Unions.

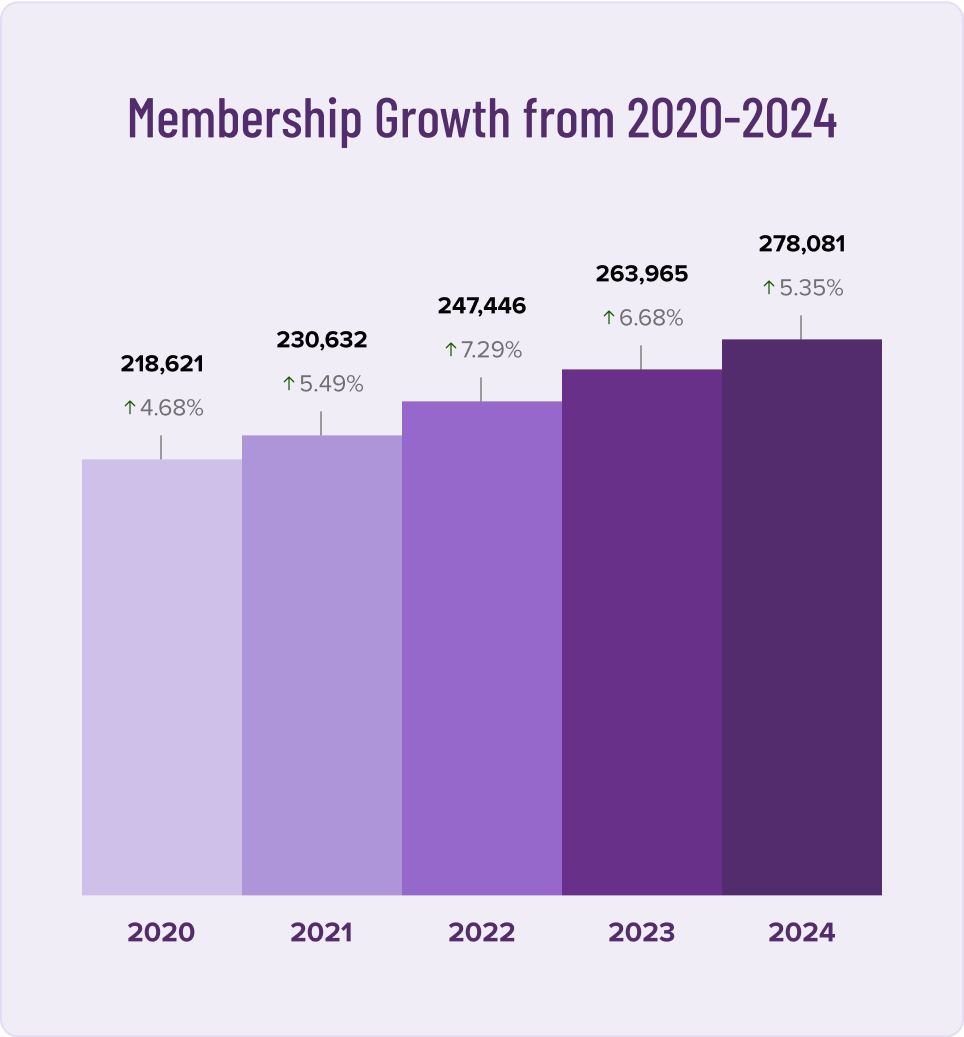

One of the Fastest–Growing Credit Unions in Minnesota

- We opened a new branch in Shakopee to accommodate this continued growth in membership.

- And, a new prime location in Richfield, just off I-494.

- And a new branch in Virginia, serving members the Iron Range!

- We remodeled, modernized, and brightened-up our Rochester branch.

Living Out Financial Inclusion

Special Olympics Minnesota

We hit the ground running (and jumping into frozen lakes) for our mission of inclusivity, generating big fundraising results for our friends at Special Olympics Minnesota.Build Wealth Minnesota

We teamed up with Build Wealth Minnesota to help underserved communities build their credit and savings.Diversity, Equity, Inclusion, and Belonging

Check out how we applied our values of Diversity, Equity, Inclusion, and Belonging within the credit union in the 2024 DEIB Report.Arise Community Credit Union & Tribe Federal Credit Union

We continued to work with Arise Community Credit Union as a resource for them as they bring resources to underserved banking communities, and we gifted $250,000 to the new Tribe Federal Credit Union seeking to establish their provisional credit union charter, as they raise money in the Twin CitiesHousing Stability Grants

Affinity Plus Foundation Awarded $230,000 in grants to 15 organizations dedicated to supporting low income first time homebuyers and other housing stability actions.

Member Experience

- Affinity Plus remains the only credit union in the state that has eliminated the non-sufficient fund (NSF) fees and also reimagined overdraft fees to benefit its members, directly benefitting nearly 20,000 members in 2024.

- Don’t just take our word for it: Our members once again gave us exceptional Net Promoter Scores. NPS scores are the standard for measuring member satisfaction and loyalty.

- Parents, kids, and teens alike enjoyed the practice loans, educational videos, chores tracking, and easy transfers in our new Affinity Plus Youth Banking app.

- Our gig-working members appreciated our launch of Real-Time Payments, giving them access to real-time payment services processed instantly, 24/7, including holidays!

- Our new Financial Counselors made their debut helping our members perceive and achieve their goals at no cost to them.

- And our amazing employees proactively reached out to our members experiencing national disasters, such as flooding, hurricanes, and wildfires in California.

- A new digital banking upgrade launched in early 2025, complete with better features, more security options, and a brand-new look!

Investment App

We’re looking forward to giving our members more control of their futures with an Investment App from the Affinity Plus Investment Center.

Hopkins Branch

We have plans for a new branch in Hopkins to better serve our rapidly expanding membership.