Annual Report 2022

Affinity Plus had a year of thoughtful growth in 2022, with a continued focus on understanding our members’ needs and how to best support them in uncertain times.

It was also another strong financial year for the credit union, giving us the opportunity to continue sharing our banking mission and community values with intention in 2023.

Who We Are

Affinity Plus is for people, not for profit. The banking cooperative started in 1930 as a way for a community to support its members and help them succeed. For 90 years, we’ve continued that tradition with caring, integrity, and learning.

Our Vision

To be the best place our members will ever bank and our employees will ever work that results in thriving communities.

Our Purpose

As a member-owned cooperative, we empower members to achieve their goals through meaningful banking experiences and a trusted financial partnership.

Our Values

Our values are Caring, Integrity, and Learning.

President's Report

Affinity Plus had one of the best years in its history in 2022. It was a year that set us apart, proving once again that by thoughtfully and strategically investing in our members, our employees and our organization, we can have strong results. Operationally, the credit union is very sound. We had another great financial year in 2022, and we’re able to do more for our members, organization, communities and one another because of it.

We continue to invest in our branch network, opening two new branches in 2022—one at Winona State University, and a second in Mahnomen following a merger with White Earth Reservation Federal Credit Union. This momentum has carried into early 2023 with the opening of our latest branch in the Midway neighborhood of St. Paul. We pledged $250,000 and donated countless hours of employees’ time and expertise to support the launch of Minnesota’s first Black-led credit union, Arise Credit Union in North Minneapolis.

We also eliminated non-sufficient funds fees (NSFs) and modernized charges for courtesy payment services in a way that helps those who need support most.

These initiatives align directly with who we are as an organization, and demonstrate how we live out our values daily in the communities we serve.

And this is a message that resonates with our members. In 2022, we saw our highest new member growth, because of you telling your friends and families about us—thank you. Our product scores are high, and our employees continue to provide exemplary banking experiences for our members.

We have no intention of slowing down in 2023. Elevating “Learning” to an organizational value will push us to do more and to be committed to our mission even when change brings discomfort.

None of it is possible without our members and the trust you put in us as an organization—thank you. And thank you to our employees for believing in us, and for the magic they bring to Affinity Plus in every branch, department, and call center.

We all make a difference together, and I’m proud of the impact Affinity Plus had in our communities in 2022. I look forward to seeing what we can do together in 2023.

Dave Larson

President/CEO

Board Chair's Report

Affinity Plus had a year of thoughtful and intentional growth in 2022, giving us a great example of how we can share our values, mission, and spirit in ways that make a true difference in our communities.

The credit union had another spectacular financial year in 2022, thanks to the great performance of our employees and the solid financial stewardship from the credit union’s leadership. This gives us the opportunity to be more intentional with how we expand Affinity Plus, and how to best serve more people.

For example, take a look at the new Mahnomen branch we opened in 2022. The community reached out to us, and we seized the opportunity as a way to implement our value of providing more access to financial resources for people who need them.

It’s a small branch, but the impact it will have on that community will continue to ripple out. And I’m proud of our leadership for investing the time and effort to make that branch shine. This is what it means and looks like when you follow through on your values.

We also saw that with Affinity Plus’ $250,000 pledged support of Arise Credit Union, Minnesota’s first Black-led credit union. Affinity Plus also donated time and financial expertise to Arise, showing that we don’t always have to own the solution to be part of it and make an impact.

And our employees respond to this work, continuously giving us high scores on surveys and the confirmation that, as an employer, we’re creating the culture that makes it a great place to work. Our investment in Diversity, Inclusion, and Belonging (DIB) began long ago, and we’re in this for the long term. The 2022 DIB Report showed how we’re putting our words into action, which is the key factor in actually doing the work toward equality.

Thank you to our leadership for another great year of showcasing our values, and thank you to the employees who live out that mission working with our members every day. I’m excited to see how we continue expanding that outreach in 2023!

Robyn Cousin

Board Chair

Financials

In 2022, Affinity Plus focused on helping members reduce financial stress and navigate uncertain economic times. This included the launch of new products, increased access to financial services, a first of its kind to restructure of courtesy pay services and an elimination of fees for insufficient funds.

As inflation grabbed hold of the economy and interest rates began to rise sharply, we leaned on lessons learned during the pandemic electing to make permanent changes to safety net programs that put more money back in the hands of our members. In June, we eliminated fees for insufficient funds and reduced the fee for courtesy pay services to $15 per item. In addition, we instituted a $100 grace zone, allowing members the comfort of knowing that they will not be assessed a courtesy pay fee if the negative balance in their account does not exceed $100. These changes combined to put nearly $5 million back in the pockets of our members in just six months!

To further our efforts to expand financial inclusion and serve more individuals, we broadened product offerings, expanded our physical footprint and enhanced community partnerships. We introduced a new spending account to increase access to traditional checking services, modernized our credit scoring methodology to improve the availability of lending and opened a new location in Mahnomen, MN to bring expanded financial services to a new community.

These actions, coupled with strong engagement from our members and communities, led the credit union to surpass $4 billion in assets at year-end and be named among Minnesota’s best credit unions by Forbes.

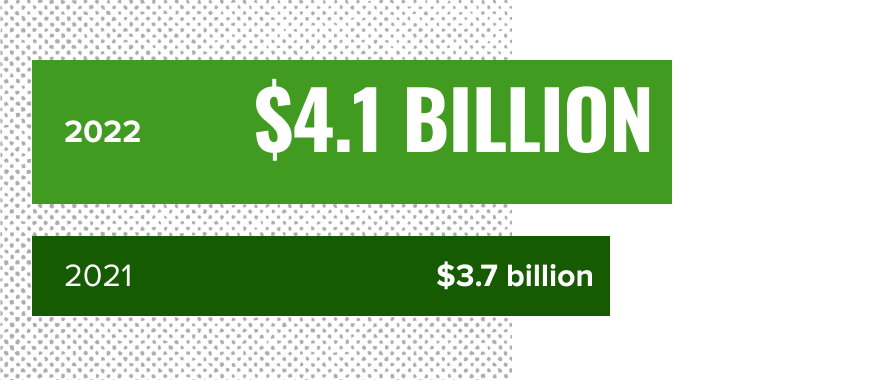

Total Assets

As a relationship-based financial co-operative, the credit union's assets primarily consist of loans to members.

On a much lesser scale, the credit union also maintains cash reserves, as well as physical property like branch locations.

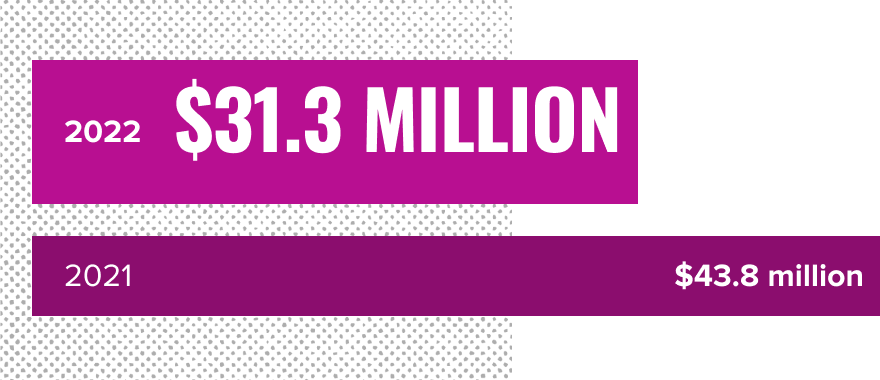

Net Income

This is our total revenue exceeding the credit union's total expenses.

These funds serve to expand the credit union's capital cushion, to provide funding for continued growth and innovation.

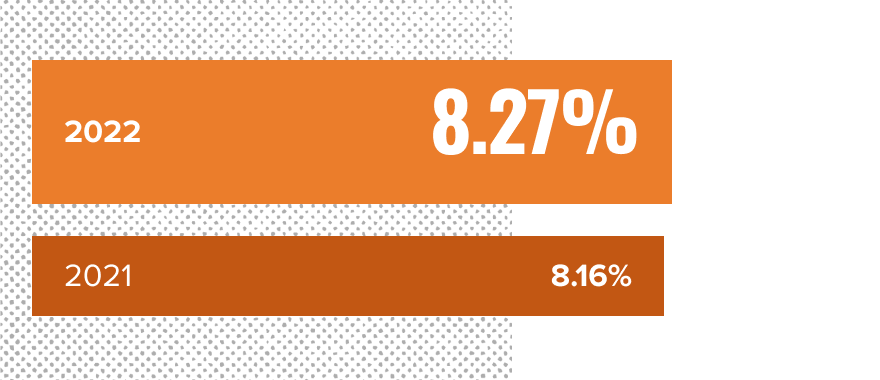

Net Worth Ratio

This is a primary measure of a credit union's capital strength. It signifies its ability to grow member relationships, fund innovation, and weather economic uncertainty.

The credit union's insurer, the National Credit Union Administration (NCUA), bestows its highest rating of “well-capitalized” upon a credit union that maintains a net worth ratio greater than 7.00%.

Year At a Glance

We had a year of thoughtful and intentional growth in 2022. We worked toward a better future in many ways, ensuring our members were always prioritized before profit, with new branch openings, products, and services to direct donations and volunteer hours to support our communities. Below are a few highlights.

Our Members

- Welcomed 21,000 new members to Affinity Plus in 2022.

- We saved members nearly $5 million in the second half of 2022 as a result of the change in our overdraft fee policies.

- Launched Early Pay to provide members access to payroll and other direct deposits up to 2 days early, at no additional cost which allows members better control over their finances.

- We enhanced our MyPlus Rewards program to bring more equitable rewards to debit card holders with an emphasis on rewarding points equally across membership segments. With the change, members saw 60% increase in the number of points they can earn per dollar spent with their debit card.

Our Employees

- Employees volunteered 6,000+ hours, including Plus It Forward Day, when all 500+ employees take the day do to some good and spread kindness in our communities.

- Welcomed the second cohort of the MBA program through Metro State University. These employees will be the future class of 2024.

- Through our continued focus on member service, we increased our Peer Rating for the Net Promoter Member Relationship Score (NPS) to 74.74. A score of 50 is considered excellent; anything over 80 is considered World Class.

Our Communities

- Opened a new branch in Mahnomen after successfully merging with White Earth Reservation Federal Credit Union. Additionally, we opened a Winona State University branch to assist students and increase our presence in Winona.

- 2,000+ volunteer hours and $20,000+ investment in bringing financial literacy, leadership and entrepreneurship curriculum into schools across Minnesota through partnership with Junior Achievement North.

- More than $160,000 contributed to Special Olympics Minnesota by Affinity Plus and its employees through the annual Polar Plunge, all in the name of building more inclusive communities.

Awards & Honors

StarTribune Top Workplace

#5 in large companies

Dave Larson - MN 500 List

Most Powerful Business Leaders in Minnesota

Forbes – Top Credit Union

#4 in Minnesota

National & Regional Marketing Awards

for Life Math Campaign

Callahan & Associates Designation for Top Member Value

#3 in the nation

Dora Maxwell Social Responsibility

for Special Olympics Polar Plunge kickstart initiative

All Are Welcome

Affinity Plus put specific focus on our efforts to boost Diversity, Inclusion, and Belonging in our communities in 2022, with new products, services, and a continued push for accessible banking for everyone. Here are a few examples:

Approving More Members

Transitioning to a new credit score model allows us to help more members, ensuring the value-driven products and services we offer are available to more people in the communities we serve. This change provided a credit score on 12,000 more members than we would have through the old model.

Arise Credit Union

Arise Community Credit Union will soon open in North Minneapolis and will be Minnesota’s only Black-led credit union. Throughout this journey, Affinity Plus has pledged a $250,000 donation and countless hours of support and expertise from our leaders. As of June 2021, there were only 264 Black American credit unions across the country, demonstrating the need for such an institution.

Dora

We’re now in our second year supporting Bank Dora Financial, which offers simple accounts for those who otherwise were or could not participate in traditional banking. Affinity Plus is actively referring people who don’t meet membership requirements, and Dora now has more than 3,000 account holders. Affinity Plus is one of five credit union owners at Bank Dora Financial, including representation on the Board of Directors.

Non-Bias Lending Practices

We are always working to ensure we are lending fair and consistently to all members and we are here to help everyone no matter what financial challenges they may be facing. In 2022, a third-party conducted research using AI modeling and found that Affinity Plus had no bias in our lending practices. Even though constant analysis is needed in this area, these findings are a confirmation we are doing the right thing.

Thank you Members

We’re proud of the work we were able to accomplish in 2022 and look forward to seeing all we can do 2023. We know none of it would be possible without you, our members, so thank you. Thank you for your support, your belief in our mission, and your trust in our values and goals. We strive to live out our values every day, with every member and in every community. Thank you.