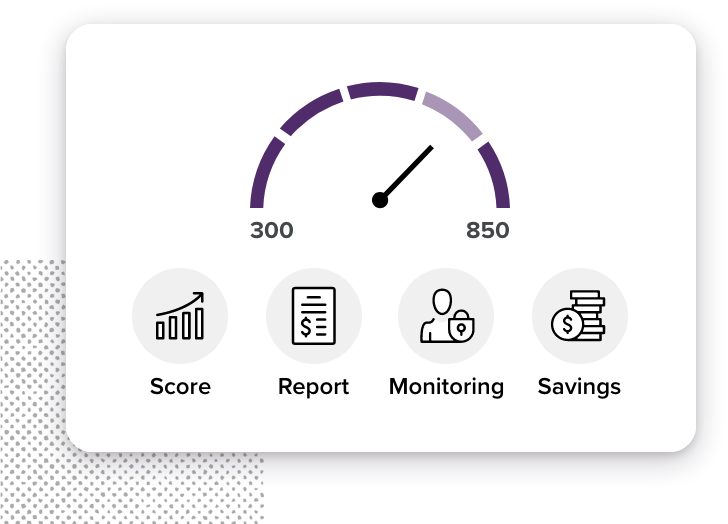

Your Credit Score. The more you know.

Curious about your credit rating? Just log in to the mobile app or online banking for easy access to your credit score, credit report and credit monitoring. All for free.

What you get for free

Your Credit Score

This number gives you a quick snapshot of your credit health.

- Updates every month automatically, but you can refresh it daily

- Scored by VantageScore 3.0, a model developed by Equifax, Experian and TransUnion

- Credit profile is pulled from TransUnion, 1 of the 3 major credit reporting bureaus

- Considers up to 200+ factors from your credit report

- Checking this won’t affect your credit score (it’s a “soft inquiry”)

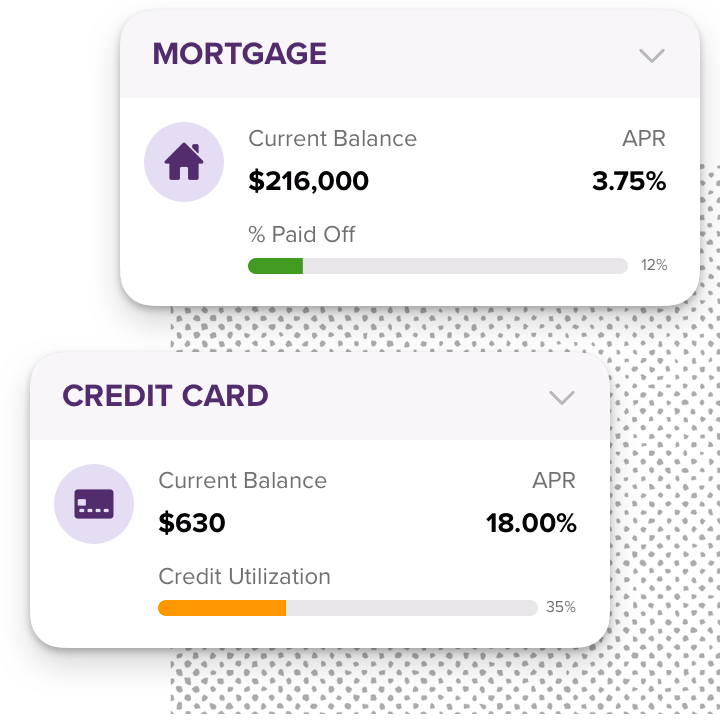

Your Full Credit Report

Your Free report contains everything you'd find on your credit file.

- Open Loans

- Open accounts

- Open credit inquiries

- Payment history

- Credit Utilization

- Public records

And checking this won't affect your credit score (it's a "soft inquiry").

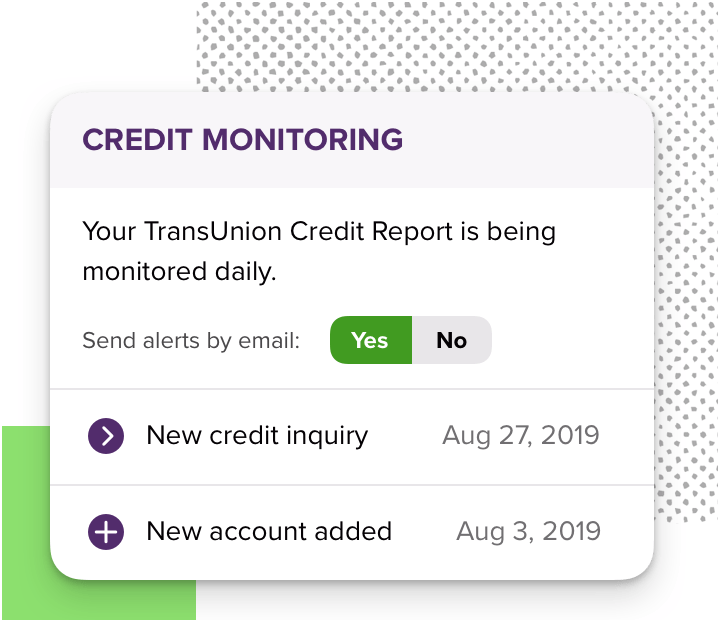

Daily Credit Monitoring

Meant to help you spot potential fraud and/or identity theft attempts, this free credit monitoring service checks your credit report daily.

You’ll get an email when the system detects any of these events related to your identity:

- New accounts opened

- Address changes

- Employment changes

- Delinquencies reported

- Credit inquiries made

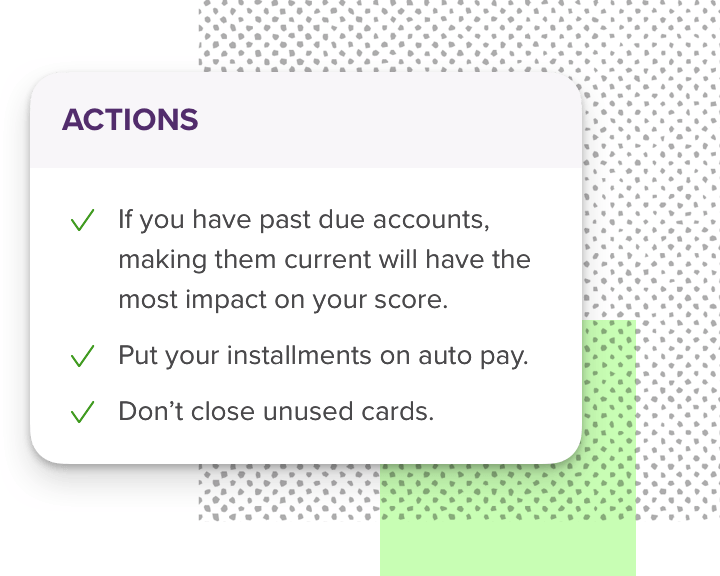

Helpful Tips

You’ll learn what affects your credit score positively and negatively, so you’ll know how to keep a great credit rating – or build your way up to one. And you’ll get loads of smart tips on managing your debt and overall financial wellness.